Catching the bounce: Improved

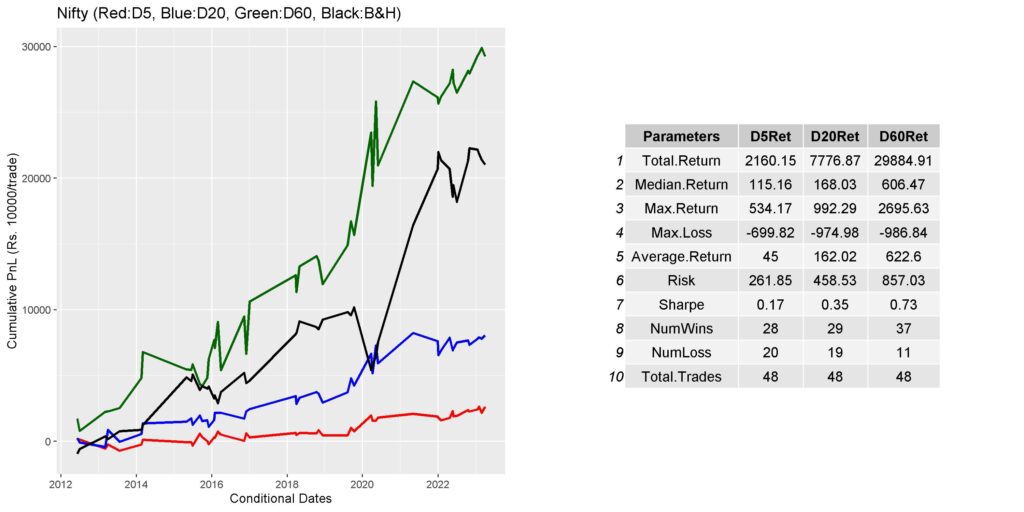

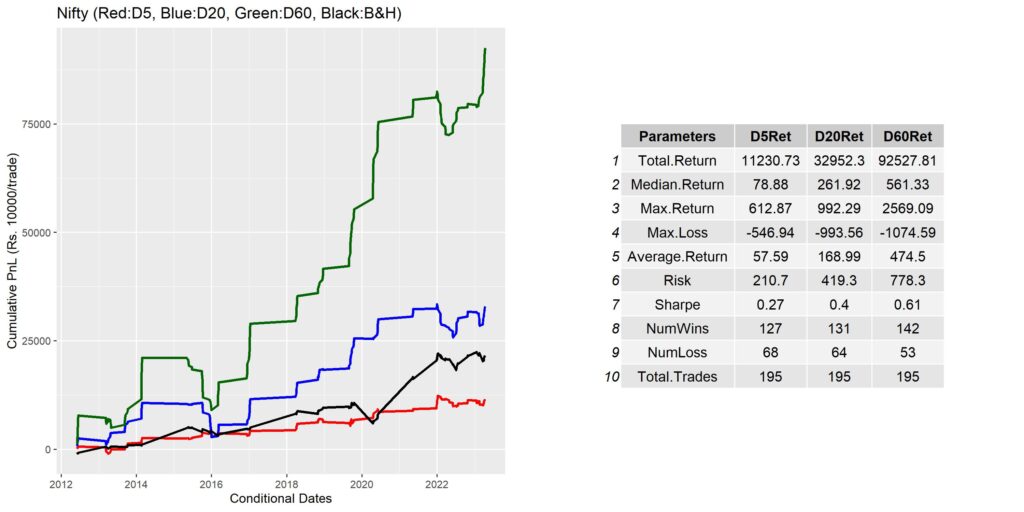

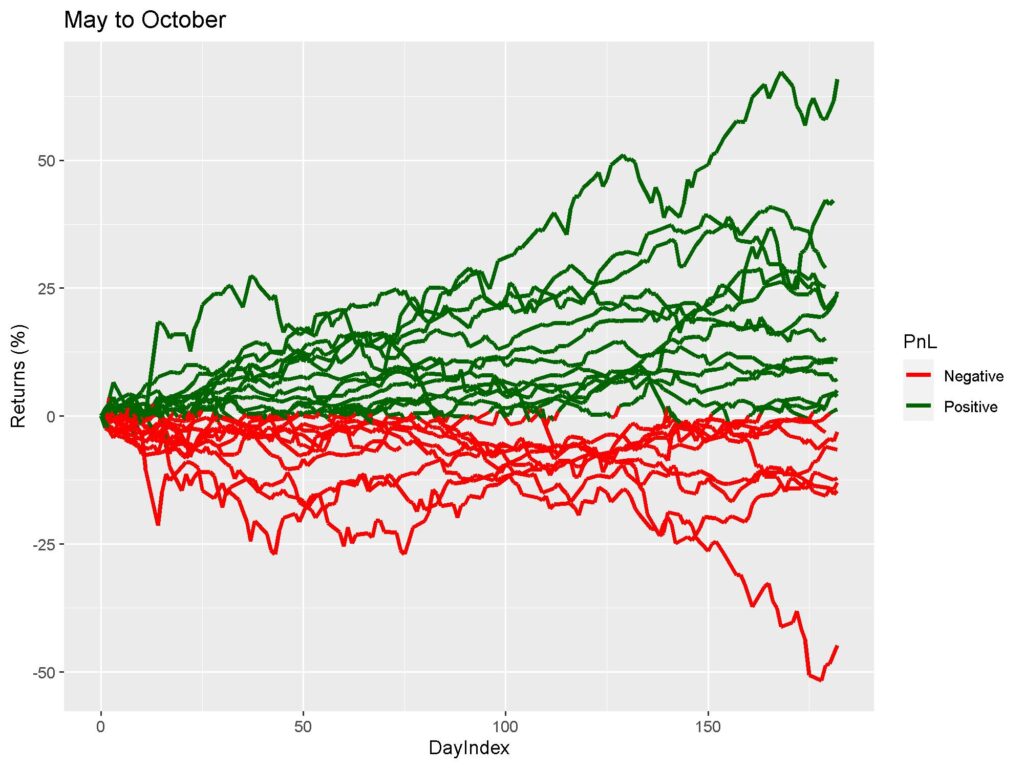

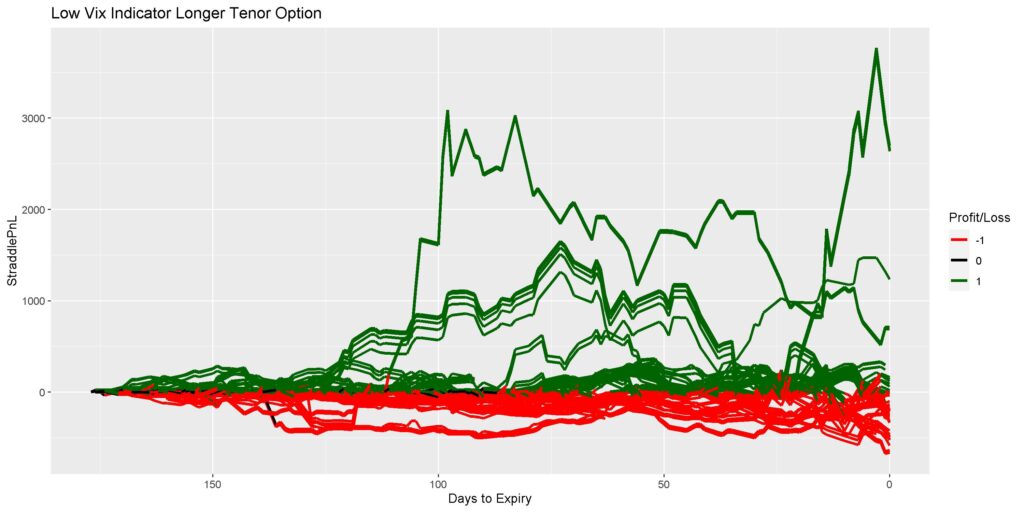

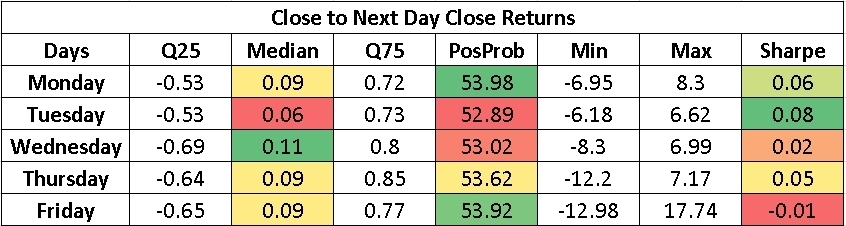

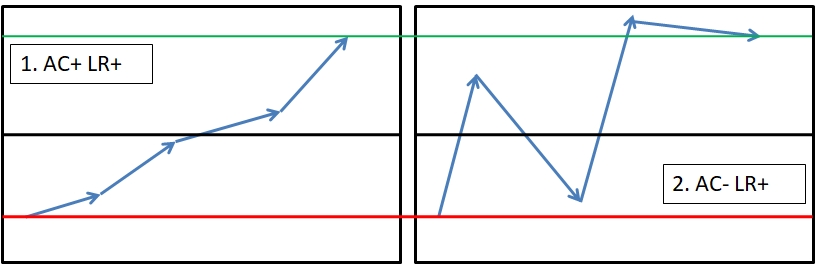

Current Index Bounce Signal Status I’m writing this article to improve upon some of the limitations that I’d observed in the previous article (Catching the Bounce, Not the Falling Knife – HERE). 1. Autocorrelation works better when it is conducted on returns (daily close to close change), rather than Close values themselves. Hence, redid that. …