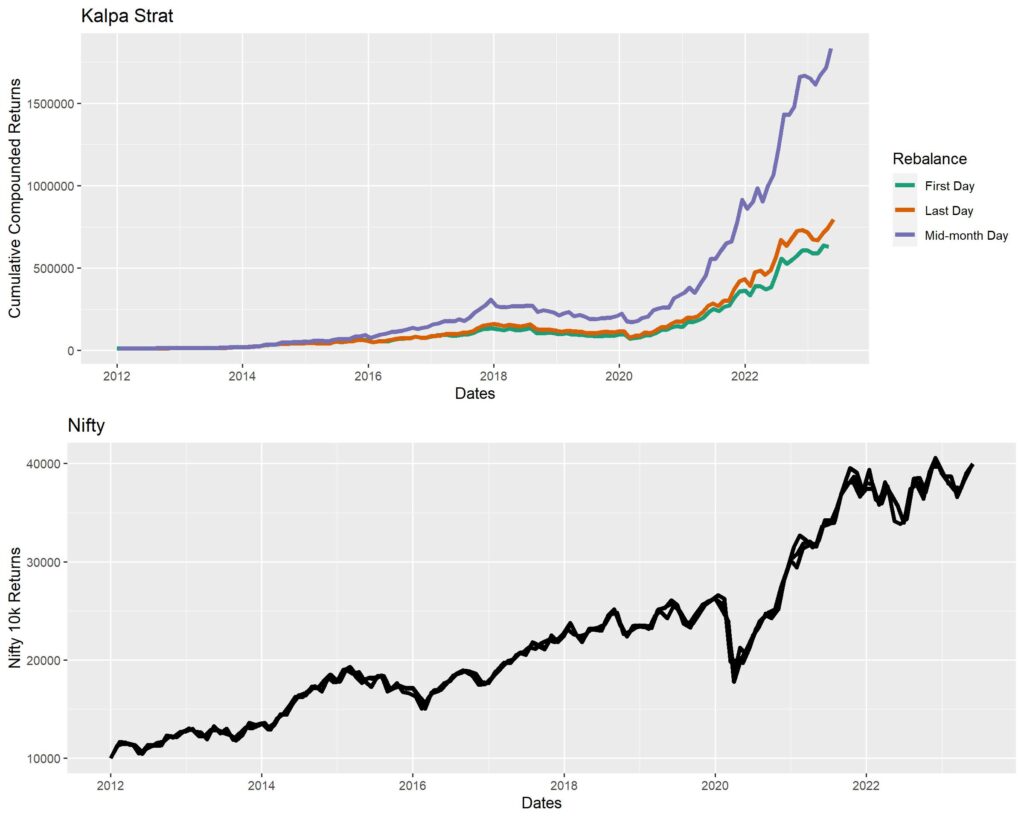

Duration weighted Stock Momentum Portfolio – The Kalpa Strat

Once in a while, I take ideas from the Fintwit community and convert it into a strat, and if useful, into a screener. This article was spawned off an idea suggested by KalpaTrader, as an extension of the NSE methodology for selecting Momentum stocks. The word “Kalpa” stands for “competent/proper/fitting” in Sanskrit. Since the results …

Duration weighted Stock Momentum Portfolio – The Kalpa Strat Read More »