Nifty Momentum for the past 6 days

Continuing on with the series of Momentum based analysis and backtests. Recently, I got to wondering whether the Nifty momentum data calculated based on 20/60 day methodology (described HERE), could be used to create a conditional SIP into the Nifty Index. However, quite a few questions come to mind:

1. How can we define Positive and Negative momentum.

2. Do we do the SIP when Nifty is in Positive momentum (momentum approach) or when it is in negative momentum (value approach)?

3. Can we do a split approach of SIPing different amounts when Nifty is in positive or negative momentum?

4. Are there any times of the month when doing a SIP would be most beneficial?

This post will try to answer all these questions, but only for those investors who are willing to accumulate (not trading/selling) in a systematic manner.

First let’s see the definitions of Positive and Negative Momentum:

1. Positive Momentum has been defined as either both M20 and M60 ratios are positive (“Positive”) and when M20 is positive and M60 is negative (“Recent Bounce”).

2. Negative Momentum has been defined as either both M20 and M60 ratios are negative (“Negative”) and when M60 is positive and M20 is negative (“Recent Crash”).

The following figure shows the times when these conditions have been met, since 2013.

Next for the backtest, I divided the buy-in into Beginning of month SIP, Middle of month SIP and End of Month SIP.

However, since the positive momentum days and negative momentum days are not equally distributed, we can’t expect the buy-ins to be of similar size. Positive momentum days were approximately double the negative momentum days.

The buy-in size for each SIP was modified such that the cumulative amount of cash expended remain the same for all strategies.

The Outcome for comparison was the number of fractional shares of Nifty (Nifty Close/Investment amount) you’d end up with if you followed the strategy from 2013 till today. The buy-in criteria was based on momentum status of previous day.

4 Strategies were compared:

1. Regular SIP irrespective of momentum: Buy-in 20k per month.

2. SIP only when Positive Momentum status on previous day: Buy-in 30k per investment.

3. SIP only when Negative Momentum status on previous day: Buy-in 60k per investment.

4. SIP 10k when Positive Momentum and 40k when Negative Momentum.

The cumulative investment amounts for all strategies are equal to 20k per month regular SIP.

Results

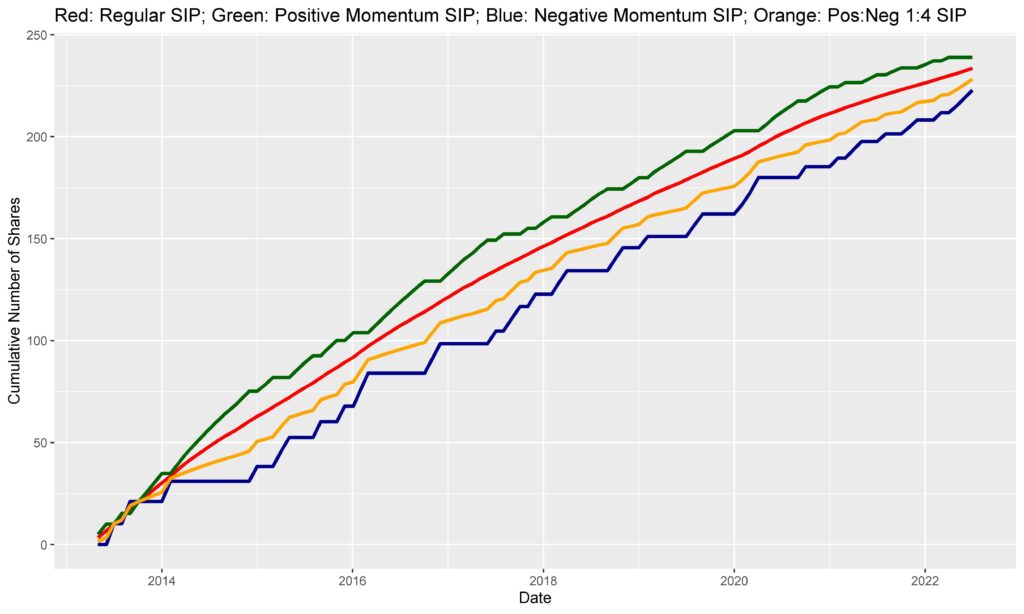

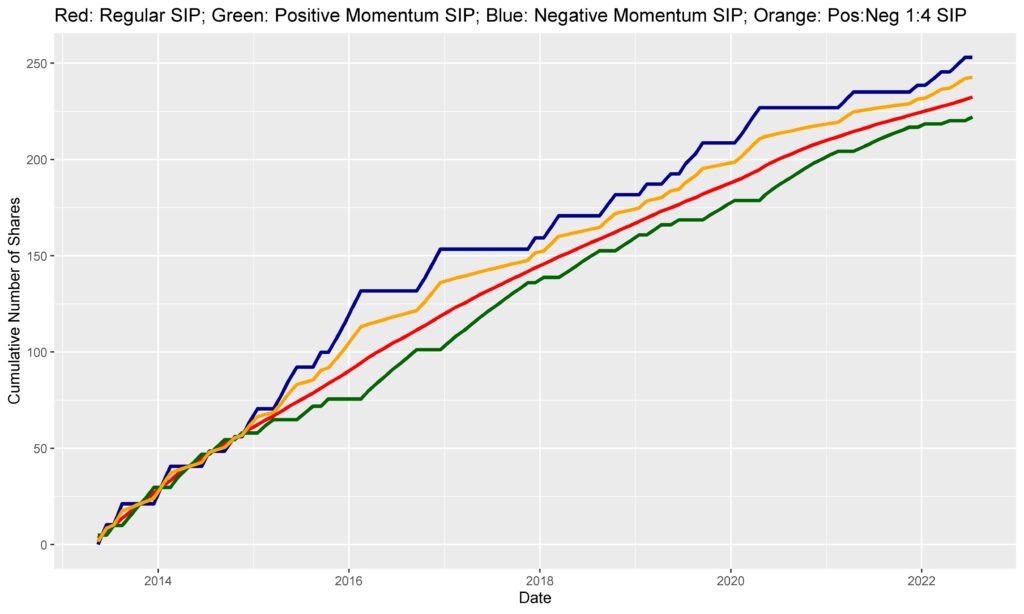

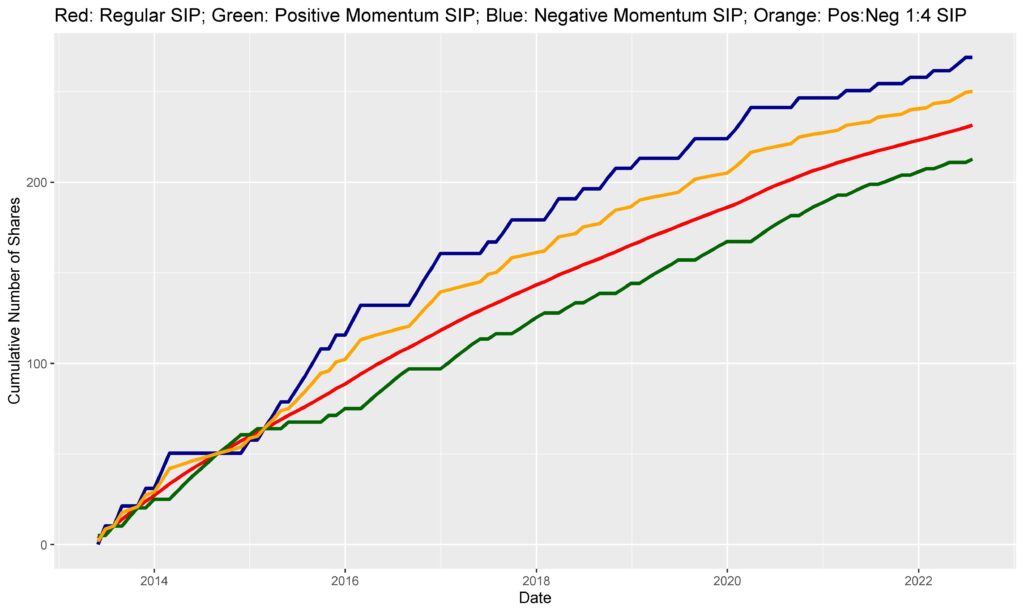

The following figures show the comparison of the four strategies for different timing of the Investment during a month:

Beginning of Month

Middle of Month

End of Month

Discussion:

Some interesting findings come to light:

1. All strategies were somewhat equally working out till 2015, after which they diverged.

2. Momentum buying (when index in positive momentum) works well when executed at the beginning of the month.

3. Value buying (when index in negative momentum) works well when executed at middle and end of month.

4. Value buying at end of month works the best.

The reasons change after 2015 might be related to high retail participation in the options market (which marked its first spike in volumes around that time). But can’t say for sure.

The reasons for end of month value out-performance, might also be related to the options market characteristics and dealer hedging or related to institutional flows etc. But these are just speculations.

Those who wish to view the results in entirety, can download it from HERE. Hope this was useful. Cheers.

PS. The Nifty momentum table at the top of page will be updated daily, for those who wish to track it. Consider bookmarking the page by pressing Ctrl+D for staying updated.

Pingback: Multi-Sector Investing by Momentum Approach - Alpha Leaks

Pingback: VIX: Vexing or Winning indicator? - Alpha Leaks

Thank you for this article. I was working on something similar. One more thing can be tried. Considering a fixed amount X for monthly, we can put Y amount in Regular SIP at a fixed date (beginning, mid, or end of the month) and the remaining amount (X-Y) to be held until we get Value buying opportunity comes