Current Index Bounce Signal Status

I’m writing this article to improve upon some of the limitations that I’d observed in the previous article (Catching the Bounce, Not the Falling Knife – HERE).

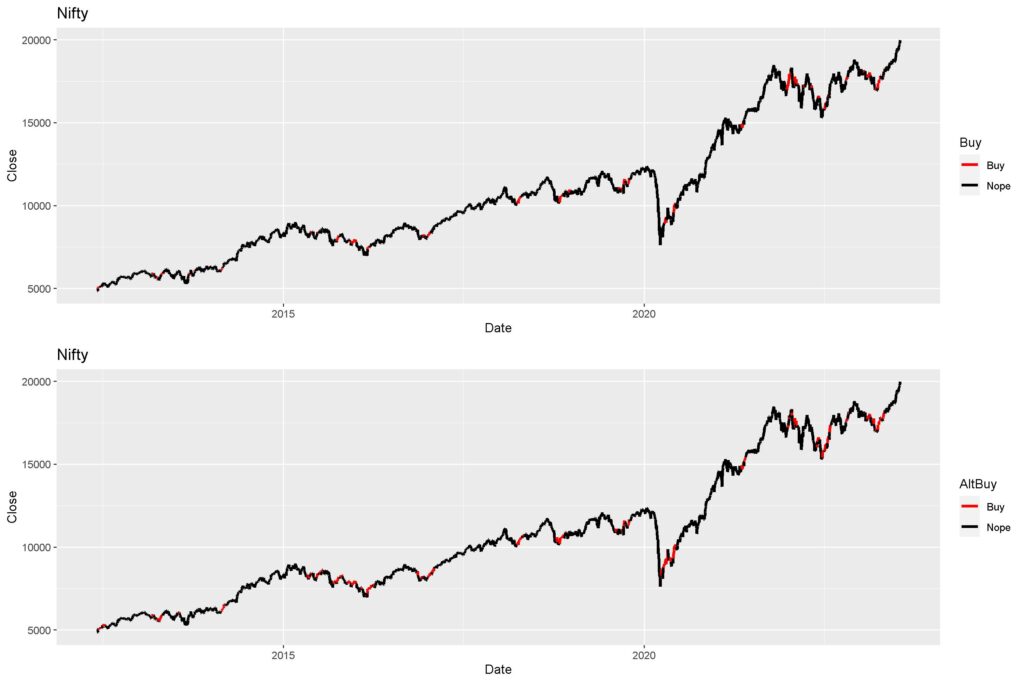

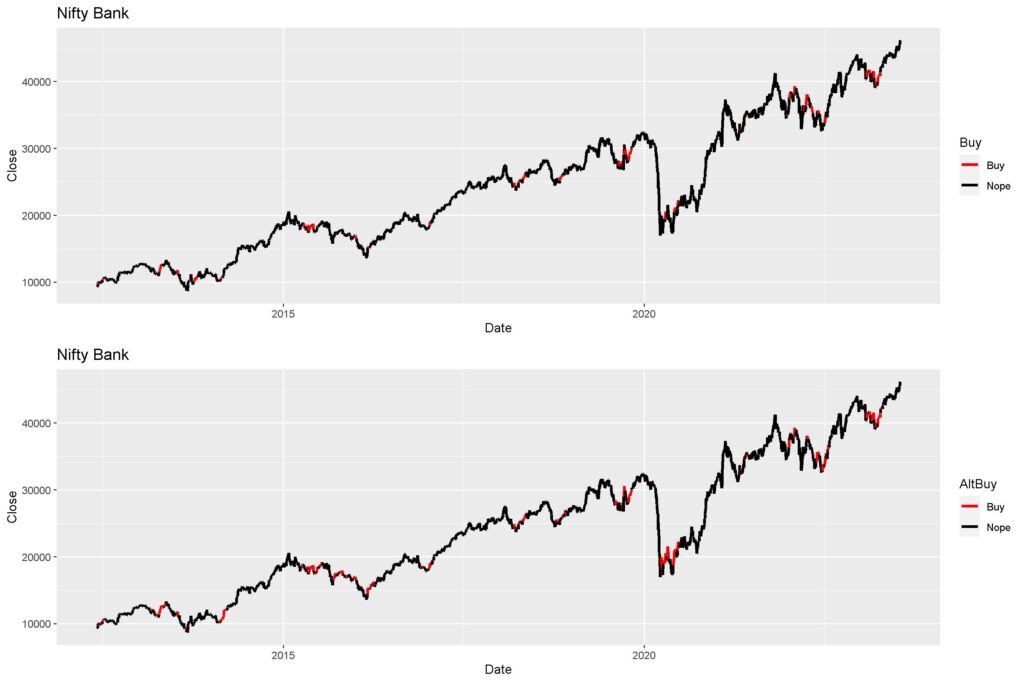

1. Autocorrelation works better when it is conducted on returns (daily close to close change), rather than Close values themselves. Hence, redid that. Observe the difference in buy signals with just this change (In Nifty and Bank Nifty). The buy signals came earlier and also persisted, leading to larger number of trades in traditional backtests.

The signal timing graphs (as below) for all indices can be accessed HERE.

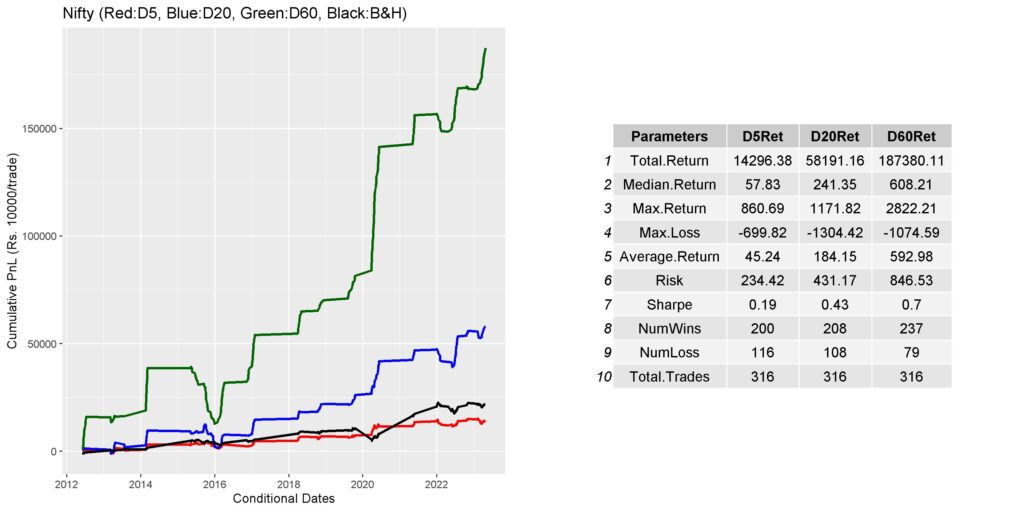

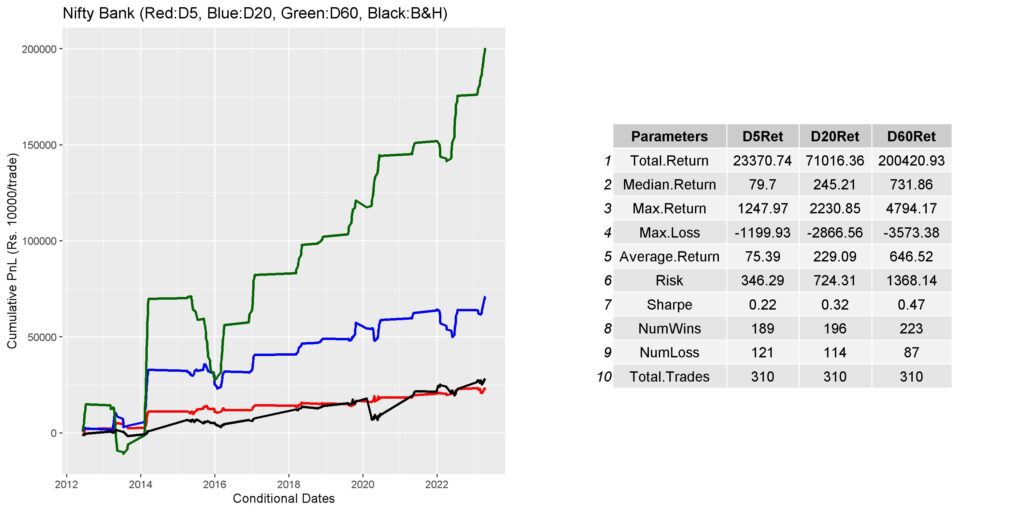

Upon conducting the backtests using this, total returns were immediately improved, but that could be an artefact of larger number of signals (rest of the indices graphs can be accessed HERE).

This leads us to the second limitation.

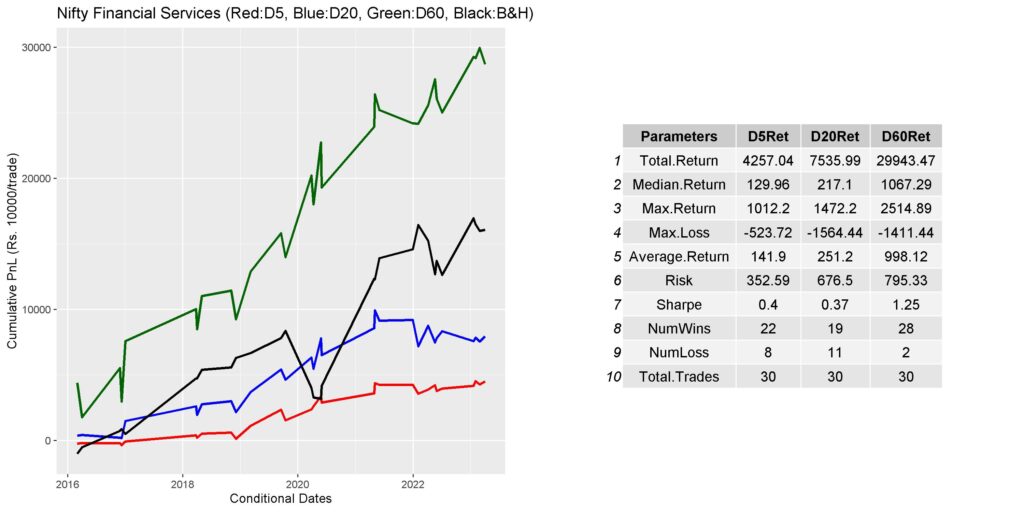

2. The D60 returns in the original backtest were stonking, mainly due to stacking of Buy signals: Most of us don’t have unlimited capital to punt if successive buy signals are observed. Hence, I reconducted the backtests such that we have exactly 10k per month to invest in an index if it shows a buy signal. The first day the signal is observed, is taken as the buy date and subsequent signals in that month are ignored.

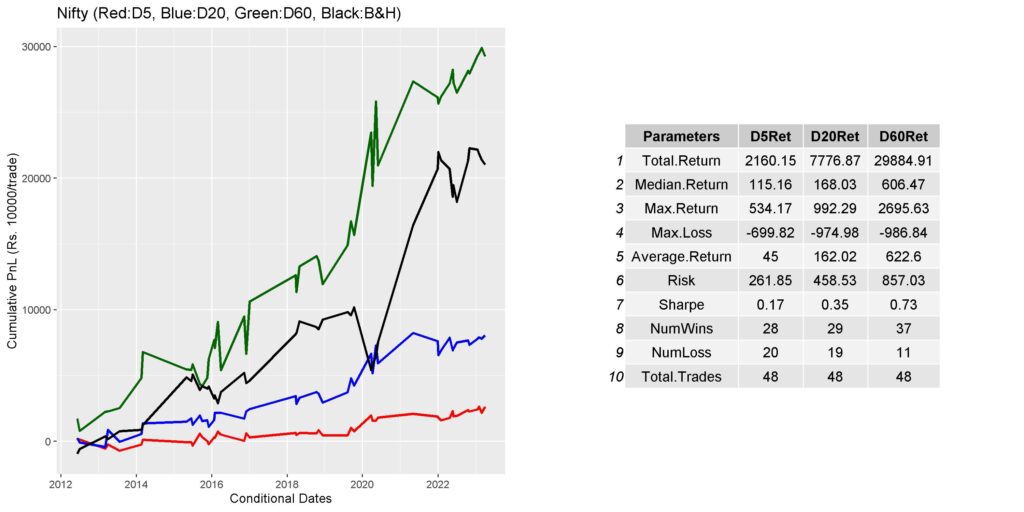

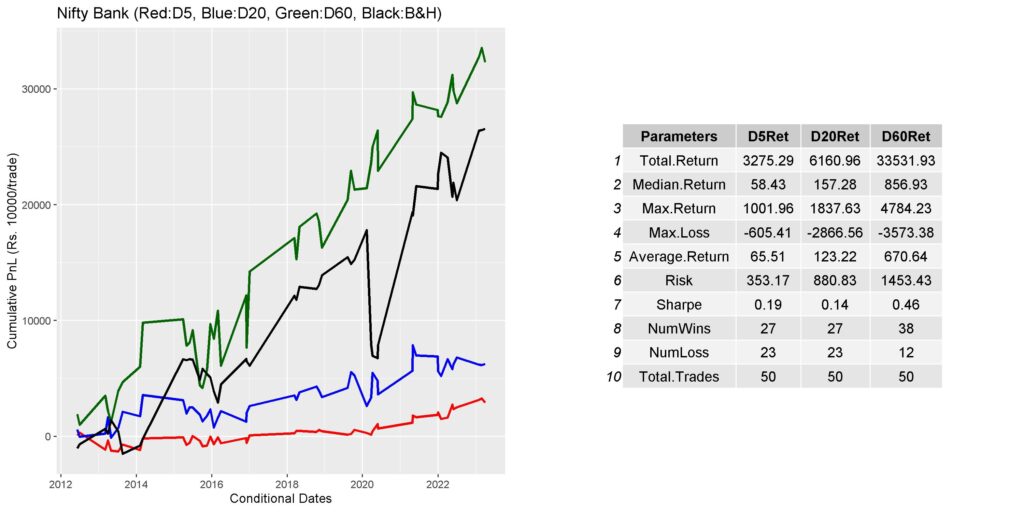

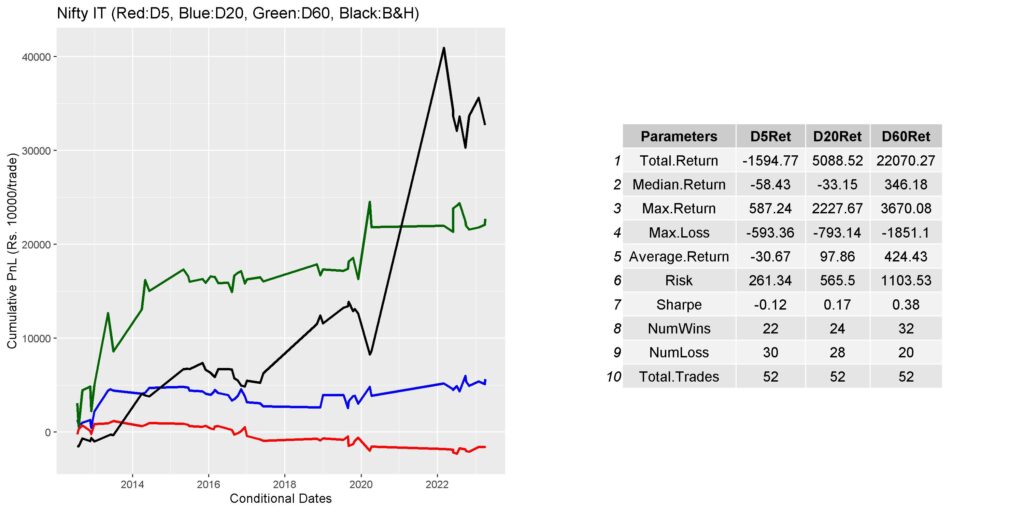

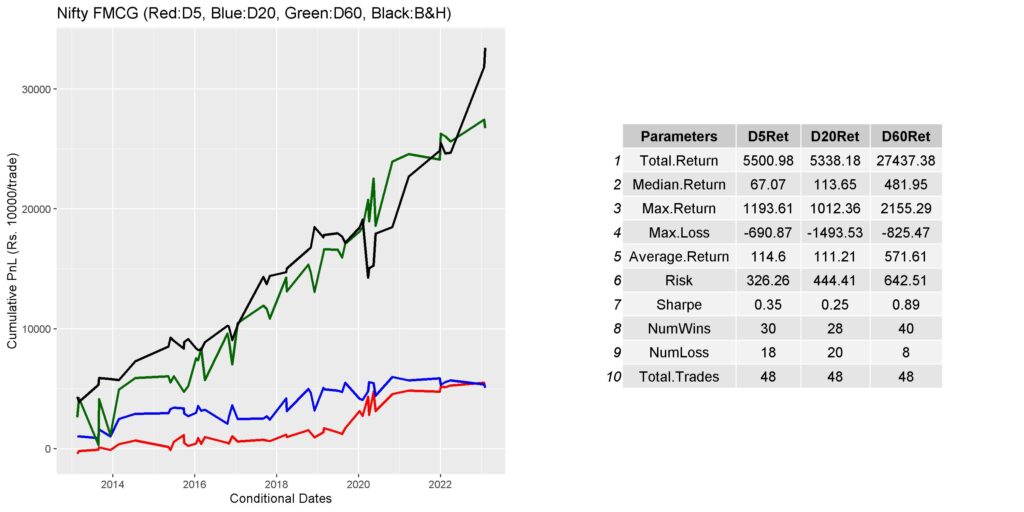

The backtest results of the useful indices are shown below. Rest can be accessed HERE.

These returns show that we might need to be index selective if we want returns over buy and hold.

It works beautifully for Nifty and BankNifty, while delivering poorer returns for FMCG and IT indices.

This might be due to a smoother index returns curve (not many opportunities to buy) or due to lack of short term trends (sharp reversals after sharp 5 day rallies). The signals do not show up if there are long term high beta positive trends (as in IT).

We need to remember that the hypothetical trades conducted in this form of backtest are not compounded. Compounding (using 10k + accumulated profit) may lead to better return profiles from this strategy vs. buy and hold.

Finally, to help people who are interested in using this strategy for investments, a table of the current signal status for all relevant indices will be kept at the top of this page, and updated daily. You may bookmark this page as a ready reference by pressing Ctrl+D.

Those interested in looking at the backtest data, can access it HERE.

Hope this was useful. Please leave a comment or comment on twitter – @Dhritiman_Ch for asking questions or clarifications. Cheers.

When do you enter exactly after signal for close to close system?

T EOD Close gives buy signal.

T+1 trade? Or T 5 minutes before market close enter?

For the backtest, I’ve used the same day signal (slightly inaccurate, I know), but due to persistence of the signal, can easily take it next day without much change in results.